The Only Guide to Whole Life Insurance

Wiki Article

Rumored Buzz on Life Insurance

Table of ContentsLife Insurance Online for DummiesThe Basic Principles Of Senior Whole Life Insurance Not known Facts About Whole Life Insurance LouisvilleFascination About Life Insurance CompanyWhat Does Life Insurance Companies Near Me Mean?

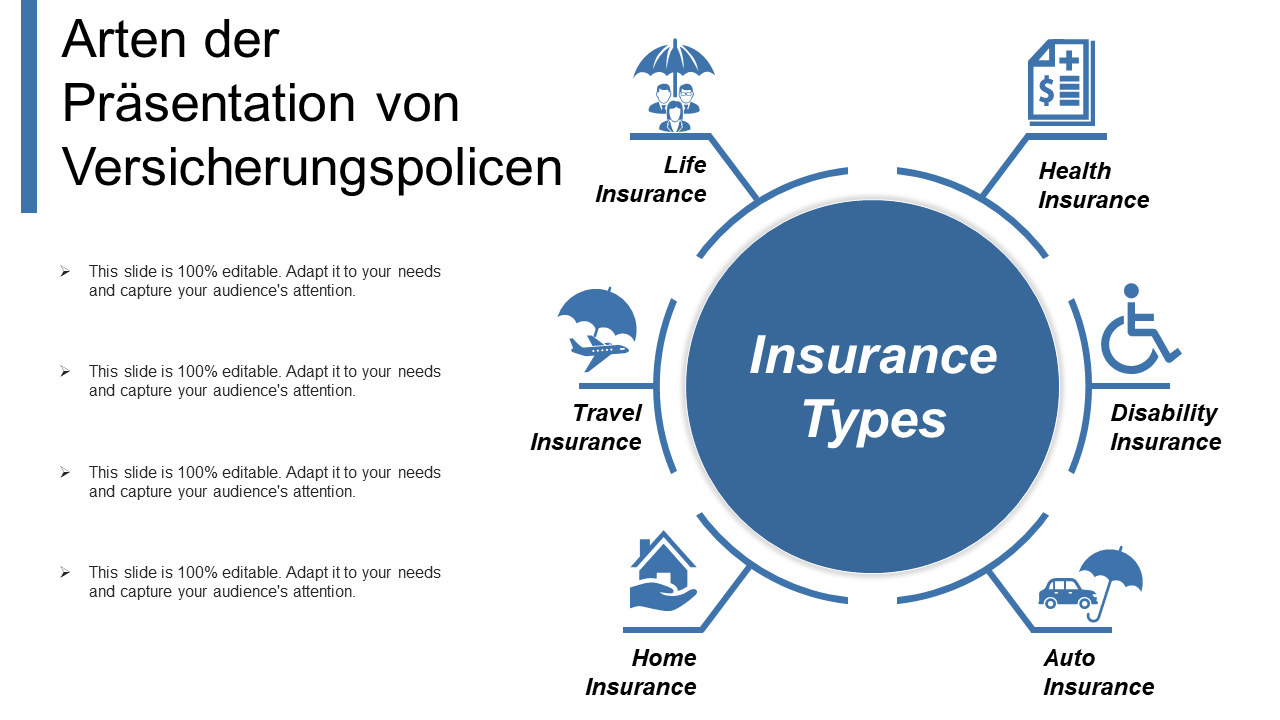

1 Definitions and Kinds of Insurance Coverage Understanding Goals Know the basic kinds of insurance coverage for individuals. Name as well as describe the various kinds of organization insurance policy. An agreement of repayment.is the firm or person that promises to compensate. The guaranteedThe individual or firm insured by an agreement of insurance. (often called the assured) is the one that receives the payment, except when it comes to life insurance policy, where repayment mosts likely to the beneficiary called in the life insurance policy contract. American Income Life.

Indicators on Life Insurance Louisville Ky You Need To Know

Every state currently has an insurance division that looks after insurance policy rates, policy standards, gets, as well as other facets of the market. Throughout the years, these departments have come under fire in numerous states for being inefficient and "slaves" of the industry. Moreover, large insurance providers run in all states, as well as both they as well as consumers should emulate fifty different state regulative plans that supply extremely various levels of defense.We start with an overview of the kinds of insurance, from both a customer as well as a business perspective. We analyze in higher information the 3 most essential kinds of insurance coverage: residential or commercial property, responsibility, and life. Public and also Private Insurance policy Often a difference is made in between public and also personal insurance policy. Public (or social) insurance coverage includes Social Safety, Medicare, momentary special needs insurance policy, as well as the like, moneyed with federal government plans.

The focus of this chapter is private insurance coverage. Types of Insurance Policy for the Individual Life Insurance Life insurance policy supplies for your family members or some various other called beneficiaries on your death. Life insurance policy with a fatality advantage but no gathered savings.

Cancer Life Insurance Fundamentals Explained

Medical Insurance Health insurance covers the price of hospitalization, sees to the medical professional's workplace, and prescription medicines. Life insurance online. The most beneficial plans, given by many employers, are those that cover one hundred percent of the prices of being hospitalized and 80 percent of the costs for medication and a medical professional's solutions. Normally, the policy will include an insurance deductible quantity; the insurance firm will certainly not make repayments until after the deductible quantity has been gotten to.

Disability Insurance policy An impairment plan pays a particular percentage of a staff member's salaries (or a taken care of amount) regular or regular monthly if the employee becomes incapable to work with ailment or a mishap. Premiums are reduced for policies with longer waiting durations prior to repayments have to be made: a policy that begins to pay a disabled employee within thirty days could cost two times as long as one that defers repayment for six months.

Little Known Questions About Life Insurance.

Automobile Insurance policy Car insurance policy is maybe the most frequently held sort of insurance - Cancer life Insurance. Vehicle plans are needed in at the very least minimal amounts in all states. The common car plan covers obligation for physical injury as well as residential or commercial property damages, medical repayments, damages to or loss of the automobile itself, and also attorneys' charges in case of a claim.An individual liability plan covers many kinds of these risks as well as can give coverage in unwanted of that given by house owner's and vehicle insurance policy. Such umbrella insurance coverage is generally relatively cost-effective, possibly $250 a year for $1 million in liability. Kinds Of Organization Insurance Policy Workers' Settlement Practically every service in every state should guarantee versus injury to workers on the job.

How Term Life Insurance can Save You Time, Stress, and Money.

Negligence Insurance Professionals such as physicians, lawyers, as well as accountants will certainly frequently purchase negligence insurance policy to safeguard versus claims made by disgruntled people or clients. For physicians, the expense of such insurance coverage has been rising over the past thirty years, greatly due to larger court honors versus medical professionals that are negligent in the method of their profession.Liability Insurance policy Organizations encounter a host of dangers that could result in significant responsibilities. Numerous kinds of policies are available, including plans for owners, landlords, as well as tenants (covering responsibility sustained on the properties); for makers and service providers (for responsibility sustained on all premises); for a business's items as well as finished operations (for liability that results from service warranties on products or injuries brought on by products); for owners as well as specialists (safety liability for damages brought on by independent specialists engaged by the insured); and also for contractual liability (for failure to comply with performances called for by specific agreements) (Whole life insurance).

Today, the majority of insurance policy is offered on a bundle basis, with single policies that cover the most vital risks. These are typically called multiperil policies. Trick Takeaway Although insurance is a demand for every US company, as well as several companies operate in all fifty states, policy of insurance coverage has actually remained at the state level.

Report this wiki page